EconoScope

(ECNS) --。The tariff war initiated by the United States is accelerating the world's move to "sell off America."。

In less than two weeks, U.S. markets have twice witnessed steep declines in stocks, bonds, and the U.S. dollar. In a single day, U.S. treasuries, often regarded as the "anchor of global asset pricing," were dumped, alongside a plunge in U.S. equities and a historic drop in the dollar.。

Dollar bill (File photo)。

Market turmoils are sending a clear message: investors are rapidly pulling out of America.。

The Wall Street Journal quoted former Senate Banking Committee Chairman Phil Gramm as saying that the current U.S. administration has already created enormous uncertainty in international trade policy.。

Historically, global financial turbulence would drive capital back into the dollar and U.S. bonds. But now, as Bloomberg put it, Washington has become the epicenter of instability. The dollar and U.S. bonds, once reliable safe havens, have lost their appeal.。

More alarmingly, this trade conflict risks evolving into a full-scale "capital war."。

So far in 2025, Bloomberg's U.S. Dollar Index has fallen more than 7 percent, marking its worst annual start since 2005. This month, a heavy sell-off in U.S. debt pushed the 10-year yield to its largest weekly increase in over two decades.。

Bloomberg said on Monday that U.S. bonds and the dollar are not playing their usual safe-haven role, a sign that markets are reacting pessimistically to tariff-driven policy shifts.。

In the short term, the sell-off of U.S. assets may reflect profit-seeking results. But the deeper issue is that as the belief in "American exceptionalism" fades, markets are naturally redefining the U.S. role in the global economic landscape.。

Adding to the pressure, the International Monetary Fund released its latest World Economic Outlook on Tuesday, projecting that U.S. GDP growth will slow to 1.8 percent in 2025, a full 0.9 percentage points lower than its January forecast and the sharpest downgrade among advanced economies.。

With rising policy uncertainty, escalating trade tensions, and weakening demand, a new consensus may be emerging in global markets: it's time to "sell off America."。

(By Gong Weiwei)。

(责任编辑:热点)

-

男人自称“为赶时间”骑走别人自行车,还从头上了锁,已被警方拘留

极目新闻通讯员 黄明杰。男人“为赶时间”竟骑走他人停在路周围的自行车,并据为己有。近来,武汉洪山警方快速反应,仅用1小时就破获了该案,追回了被盗自行车。“我的自行车被偷了,应该是忘了锁!”4月6日正午

...[详细]

极目新闻通讯员 黄明杰。男人“为赶时间”竟骑走他人停在路周围的自行车,并据为己有。近来,武汉洪山警方快速反应,仅用1小时就破获了该案,追回了被盗自行车。“我的自行车被偷了,应该是忘了锁!”4月6日正午

...[详细]

-

12月15日,记者从合肥轨迹交通集团得悉,到2022年12月13日,合肥轨迹线网总客流创新纪录,打破11亿人次,达110065.03万人次。此外,备受市民重视的5号线北段试乘组织也将于本周内对外发布,

...[详细]

12月15日,记者从合肥轨迹交通集团得悉,到2022年12月13日,合肥轨迹线网总客流创新纪录,打破11亿人次,达110065.03万人次。此外,备受市民重视的5号线北段试乘组织也将于本周内对外发布,

...[详细]

-

10万元现金已交给骗子 还有30万差点也上圈套 武昌警方为武汉女子保住了40万元

□楚天都市报极目新闻记者 吴昌华 通讯员 孙逊 黄若灵。武汉一名女子亲手把10万元现金交给了骗子派来的取款人之后,愈加信任“每天收益3个点的出资”,直到武昌警方找到她,她仍不供认,宣称“你们认错了人”

...[详细]

□楚天都市报极目新闻记者 吴昌华 通讯员 孙逊 黄若灵。武汉一名女子亲手把10万元现金交给了骗子派来的取款人之后,愈加信任“每天收益3个点的出资”,直到武昌警方找到她,她仍不供认,宣称“你们认错了人”

...[详细]

-

中信银行合肥分行6000万元绿色PPP项目固定资产借款支撑绿色、循环和低碳经济发展

近来,合肥分行成功为某水务有限公司发放固定资产借款6000万元,用于其在污水处理厂PPP项目,有用处理了企业的资金困难,也活跃践行了绿色、循环和低碳经济开展的国家战略。一直以来中信银行高度重视、仔细贯

...[详细]

近来,合肥分行成功为某水务有限公司发放固定资产借款6000万元,用于其在污水处理厂PPP项目,有用处理了企业的资金困难,也活跃践行了绿色、循环和低碳经济开展的国家战略。一直以来中信银行高度重视、仔细贯

...[详细]

-

天山南北·驼铃新声|新疆“超级棉田”第五季开端春播 才智农业再晋级

近来,气候回暖,新疆“超级棉田”第五季春播全面打开。在从前的基础上,本年春播,“超级棉田”更新了更多的栽培技能和设备。2021年头,极飞科技在新疆巴音郭楞蒙古自治州尉犁县启动了“超级棉田”项目。艾海鹏

...[详细]

近来,气候回暖,新疆“超级棉田”第五季春播全面打开。在从前的基础上,本年春播,“超级棉田”更新了更多的栽培技能和设备。2021年头,极飞科技在新疆巴音郭楞蒙古自治州尉犁县启动了“超级棉田”项目。艾海鹏

...[详细]

-

中信银行合肥分行用实际行动担任惠企利民职责,助力实体经济发展

中信银行合肥分行坚决贯彻执行党中央、国务院、中国人民银行及总行关于减费让利、惠企利民决议计划布置,活跃推进减费让利方针落地收效,用实际行动担任惠企利民职责,助力实体经济发展。进步政治站位,保证方针落地

...[详细]

中信银行合肥分行坚决贯彻执行党中央、国务院、中国人民银行及总行关于减费让利、惠企利民决议计划布置,活跃推进减费让利方针落地收效,用实际行动担任惠企利民职责,助力实体经济发展。进步政治站位,保证方针落地

...[详细]

-

湖北日报讯 记者方桐、通讯员冯璇、李梦婷、蔡青阳)“这次体检除了惯例项目,还对心脑血管进行了仔细查看,对咱们来说很有必要。”近来,应城市新都化工有限责任公司行政总监谢建伟应约来到应城市人民医院,参加该

...[详细]

湖北日报讯 记者方桐、通讯员冯璇、李梦婷、蔡青阳)“这次体检除了惯例项目,还对心脑血管进行了仔细查看,对咱们来说很有必要。”近来,应城市新都化工有限责任公司行政总监谢建伟应约来到应城市人民医院,参加该

...[详细]

-

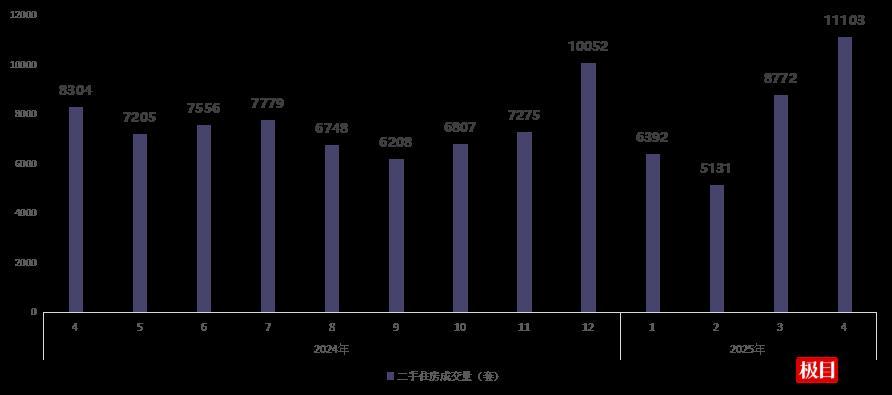

本年4月武汉二手房买卖11103套,武昌区环比增幅68.43%最高

极目新闻记者 马清妮。5月15日,极目新闻记者从武汉房地产生意与租借协会得悉,2025年4月,全市二手住所买卖11103套,成交量环比添加26.57%,同比增幅33.71%,是近两年来月度成交量最高的

...[详细]

极目新闻记者 马清妮。5月15日,极目新闻记者从武汉房地产生意与租借协会得悉,2025年4月,全市二手住所买卖11103套,成交量环比添加26.57%,同比增幅33.71%,是近两年来月度成交量最高的

...[详细]

-

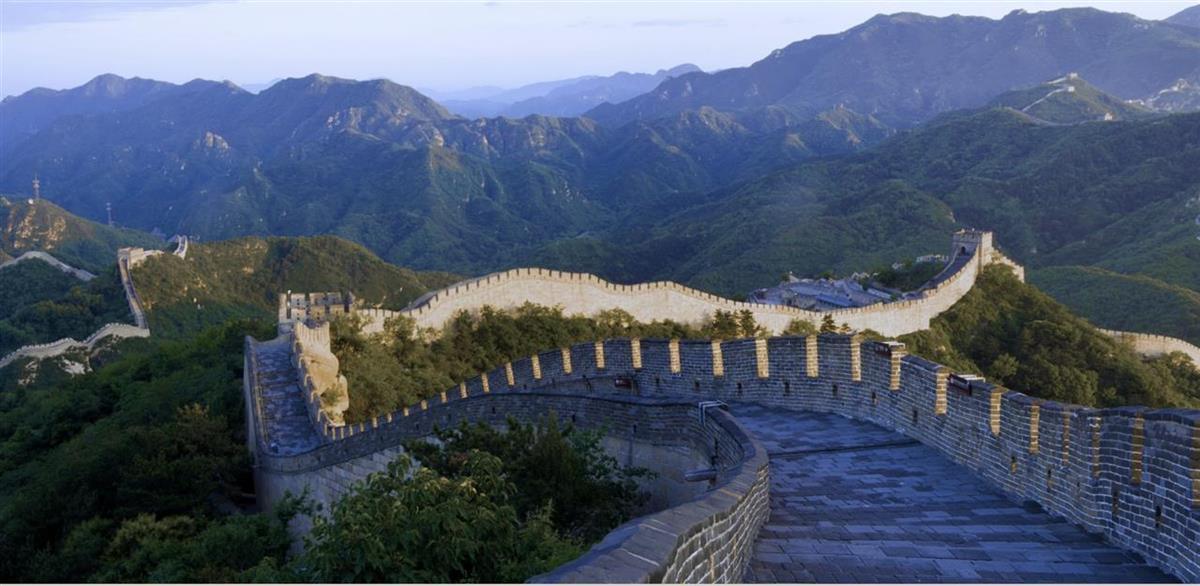

极目新闻记者 姚赟。4月10日,北京市气象台发布近10年来首个劲风橙色预警,估计4月11日下午至13日白日,北京西部、北部山区将呈现11级至13级瞬时阵风,平原区域阵风可达9级至11级。北京市气象台专

...[详细]

极目新闻记者 姚赟。4月10日,北京市气象台发布近10年来首个劲风橙色预警,估计4月11日下午至13日白日,北京西部、北部山区将呈现11级至13级瞬时阵风,平原区域阵风可达9级至11级。北京市气象台专

...[详细]

-

湖北日报讯 记者方桐、通讯员冯璇、李梦婷、蔡青阳)“这次体检除了惯例项目,还对心脑血管进行了仔细查看,对咱们来说很有必要。”近来,应城市新都化工有限责任公司行政总监谢建伟应约来到应城市人民医院,参加该

...[详细]

湖北日报讯 记者方桐、通讯员冯璇、李梦婷、蔡青阳)“这次体检除了惯例项目,还对心脑血管进行了仔细查看,对咱们来说很有必要。”近来,应城市新都化工有限责任公司行政总监谢建伟应约来到应城市人民医院,参加该

...[详细]

沙洋一派出所一天内连获双面锦旗

沙洋一派出所一天内连获双面锦旗 美好有约再拓维 “泰康宗族办公室解决方案系统”正式发布

美好有约再拓维 “泰康宗族办公室解决方案系统”正式发布 实时比出“石头、剪刀、布” 机械手与操作者神同步

实时比出“石头、剪刀、布” 机械手与操作者神同步 全球媒体聚集丨美国燃油车怎么同我国的电动车竞赛?美国能源行业人士重视我国可再生能源优势位置

全球媒体聚集丨美国燃油车怎么同我国的电动车竞赛?美国能源行业人士重视我国可再生能源优势位置 做噩梦时总乱动?或许预示帕金森病

做噩梦时总乱动?或许预示帕金森病